AI chat is becoming the front door to travel. As booking windows compress and platform shares shift, the winners will redesign the end‑to‑end journey around dialog—not clicks.

Why this matters now

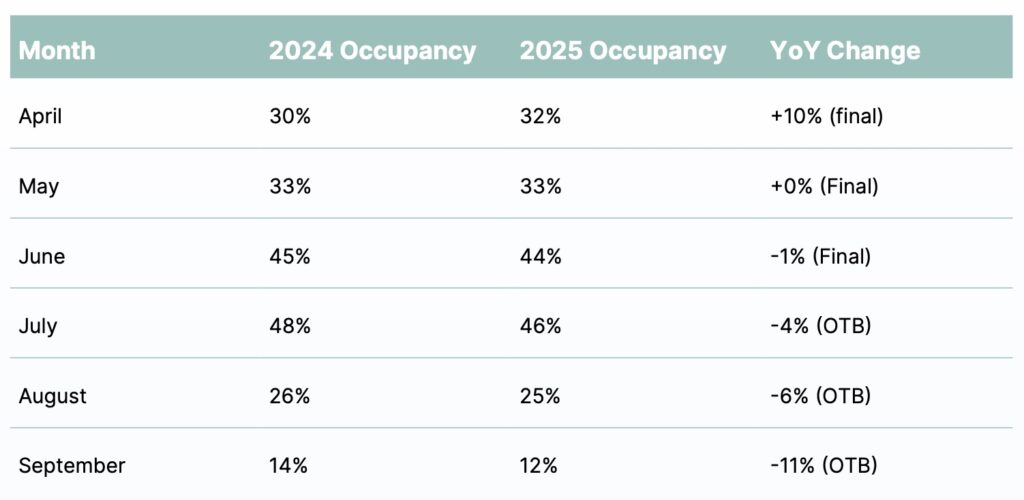

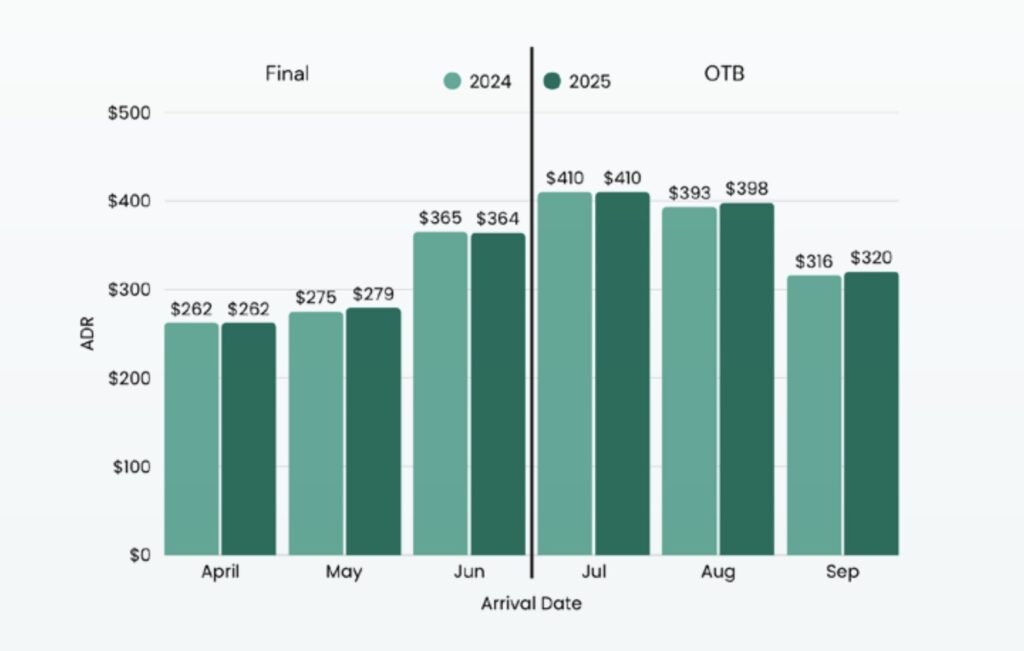

Across U.S. short‑term rentals, demand is volatile, and the planning clock is ticking faster. In Q2 2025, forward occupancy slipped, down 6% for August and 11% for September, while the average booking window compressed by 2-6% across the summer months according to a recent report from KeyData. Average stay length edged down by ~0.2 days.

These shifts concentrate decisions into shorter time frames and elevate the value of tools that remove friction and accelerate confidence, which is precisely what conversational interfaces do.

At the same time, distribution is rebalancing. Direct bookings’ share has fallen from 28 to 26 percent, even as one large marketplace gained reservation share to 45 percent; another declined to 21 percent. Price levels are surprisingly steady. Average daily rates have held or ticked up ~1 percent, even as revenue pressure persists.

Conversational discovery changes how travelers find options across these channels and who earns the right to convert them.

The traveler’s journey—redesigned for conversation

Below I outline five phases, show what today’s traveler is already asking of tools like ChatGPT and AI‑powered search, and describe how leading booking platforms can respond.

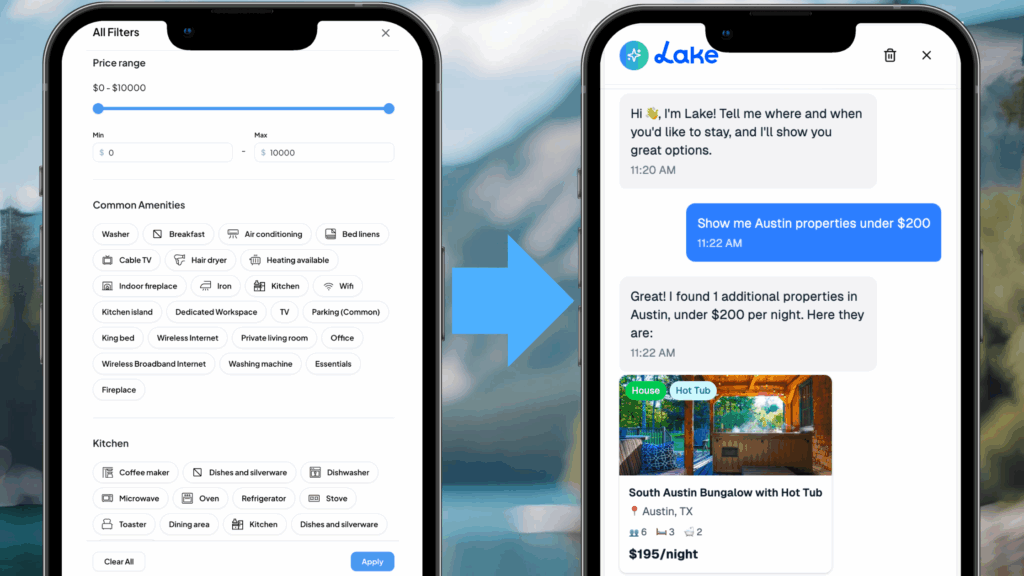

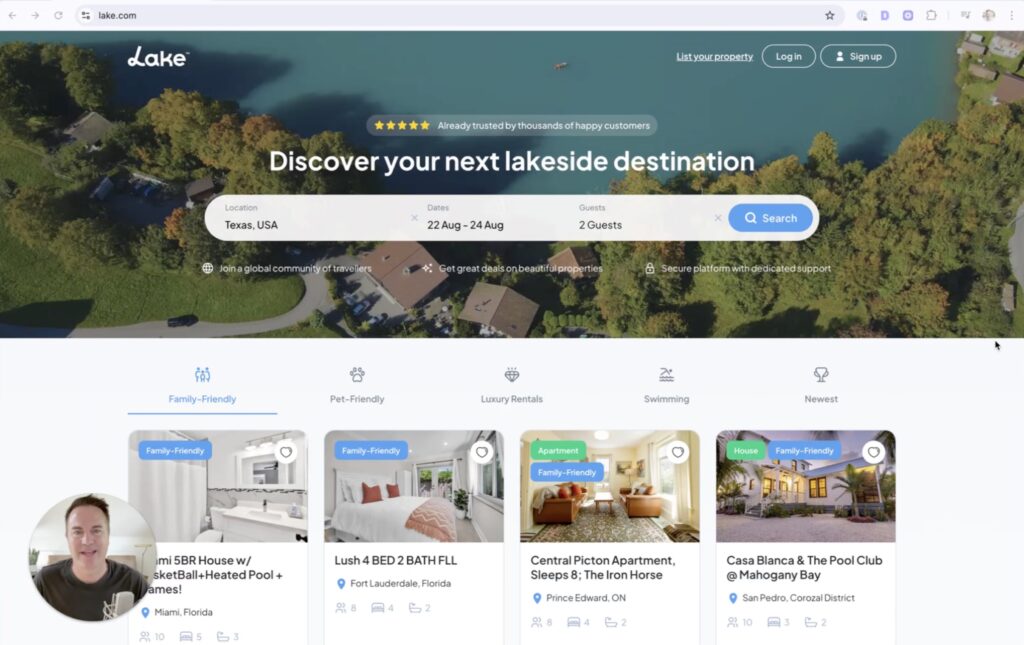

We include examples of how Lake.com is beginning to support each phase, building on the conversational prototypes demonstrated by its team (e.g., “Austin under $200,” “Dallas or Houston houses for eight people,” and “available sometime in September within a $180-$250 budget”).

1) Inspiration — “I want to know”

What travelers type into AI:

- “We want a lakeside getaway within a 4‑hour drive of Chicago, pet‑friendly and quiet for toddlers. What are three great areas and why?”

- “Show me hidden‑gem lake towns where the water is warm enough to swim in June and there’s a public marina.”

- “Give me two sample weekends with the best chance of fair weather and lower prices.”

What leaders do:

Move from keyword search to intent capture. Replace long filter panels with natural‑language understanding that reads “quiet cove,” “shallow shoreline,” or “pets welcome” as intents, not toggles. Power the dialog with a structured content graph that knows places, seasons, and amenities, and can surface credible, place‑based editorial – not ads.

Lake.com in action:

Lake.com is leaning into this foundation: 1,400 lakes, 3,000 marinas, 4,400 parks, and a growing editorial library sit behind 1,000 live property pages (and backlog of 40,000 we’re now onboarding). This structured graph lets a traveler ask for “lakes near Austin with kid‑friendly swimming and a dock,” and see relevant options without manual triage.

Data signal to watch: With booking windows shortening in peak months, inspiration is migrating closer to the moment of commitment; content has to help guests decide faster, not just dream longer.

2) Consideration — “Help me compare”

What travelers type into AI:

- “Lake A vs. Lake B for a family of five with a small dog: pros, cons, and typical costs.”

- “Is Property 1 or Property 2 better if we need a dock, two true bedrooms, and a quiet cove?”

- “Rank options under $250 a night near fuel docks and a public beach; explain your top three.”

What leaders do:

Make comparison a conversation. Summarize reviews, quantify distance to marinas and parks, and present trade‑offs in plain language (“quieter cove, longer drive to boat rental”). Enable collaborative shortlists that families can share by text or email. Confidence, not volume, wins this messy middle.

Lake.com in action:

Lake.com’s “Favorites” can be organized into collections and shared; lake‑versus‑lake patterns and amenity logic (dock, waterfront, pets) make side‑by‑side evaluation straightforward. Editorial safety notes and family‑fit cues (“shallow shoreline”) speak to real‑world concerns.

Data signal to watch: Direct bookings still deliver strong economics but are losing share; travelers are cross‑shopping across platforms more than before, making neutral, high‑trust comparisons decisive.

3) Planning — “I want to go”

What travelers type into AI:

- “Find a two‑bedroom lakeside cabin with a dock within $180-$250 per night, available any 3-5 days in September; we’re flexible ±3 days.”

- “What’s the best week at Lake X for lower prices and fewer crowds? Are boat rentals available mid‑week?”

- “Create a 5‑day plan for kids under 8: swimming, easy hikes, and a rainy‑day museum.”

What leaders do:

Expose price and availability through the conversation. Offer flex‑date search, “best week” recommendations, and calendar heatmaps that trade off price, inventory, and crowding. Bring in local events, rental availability, and itineraries to collapse the back‑and‑forth.

Lake.com in action:

The site is piloting conversational queries paired with calendar intelligence (“best week for price and availability”), plus itineraries and checklists for 2-3 and 5 to 7‑day stays that integrate nearby marinas and parks.

Data signal to watch: Forward occupancy is lagging, especially in late summer, and booking windows are shortening. Planning experiences must help guests commit sooner while preserving flexibility.

4) Booking — “I want to book (with confidence)”

What travelers type into AI:

- “Is this property available for six people from Oct 12-15? What’s my all‑in price with fees and taxes?”

- “Can I hold it for 10 minutes while I confirm flights?”

- “Is there a lower price for these dates anywhere else?”

What leaders do:

Close the loop inside the conversation. Show real‑time availability and transparent totals; state cancellation terms in one sentence; and, where appropriate, offer short, time‑bound holds. Maintain price integrity across channels and explain it clearly.

Lake.com in action:

Fast property pages, fee transparency, family‑fit icons, reviews, and clear refund policies are in place. The team is exploring assurance and scarcity cues that inform without pressuring, aligned with a conversational checkout.

Data signal to watch: Platform mix is tilting toward marketplaces (one at 45 percent reservation share) while direct is slipping; shoppers will see prices everywhere. Consistent, explainable pricing and smooth chat‑to‑checkout handoffs are table stakes.

5) Experiencing — “Make the stay great—and next season easier”

What travelers type into AI:

- “Which marinas on Lake X have boat rentals and kids’ life jackets?”

- “Quiet coves safe for swimming this weekend and a lunch spot with a dock?”

- “Save our favorite week next year and ping me if the price drops.”

What leaders do:

Turn the stay into a guided conversation: mobile day plans, safety reminders, and one‑tap directions; then, a gentle arc from review to re‑book. Collect guest photos and insights to improve recommendations for the next trip.

Lake.com in action:

Guides to parks and marinas exist across major lakes; the roadmap includes on‑trip concierge content (“kid‑friendly day at {Lake}”) and an integrated loop from post‑stay review to next‑season holds.

Data signal to watch: With stays slightly shorter and booking windows tighter, repeat guests become a stabilizer, conversational re‑booking can grow lifetime value even as demand fluctuates.

What conversational travel looks like in practice

Four design shifts separate leaders from the pack:

- From filters to intents. Let people ask, “quiet cove for toddlers near a fuel dock,” and map that to content and inventory—no checkbox gymnastics.

- From pages to threads. Treat every journey as a running conversation that remembers preferences and context across devices.

- From listings to plans. Bundle a home with nearby activities, rental logistics, and weather norms to answer the real question: “Will this work for my family?”

- From clicks to confidence. Make availability, all‑in price, policies, and trust symbols inside the chat.

The operating context

- Booking windows compressed 2-6 percent in summer months; average stay length decreased ~0.2 days, raising turnover costs and stressing last‑minute pricing.

- Forward occupancy is weakest in late summer; September is down 11 percent year‑over‑year on the books

- Distribution is consolidating toward large marketplaces even as direct retains superior unit economics; price levels remain stable with ~1 percent gains into late summer despite softer occupancy.

The blueprint for we’re following: conversation first, end‑to‑end

Near term (next 90 days)

- Instrument the dialog. Capture top five intents by lake and family type; train prompts that return availability, price, and a one‑paragraph value summary.

- Expose flexible calendars. Offer “best week” guidance and heatmaps in chat to counter compressed booking windows and rebuild confidence to commit.

- Clarify price integrity. State all‑in totals and policy highlights in the thread; explain when (and why) direct and marketplace prices differ.

Medium term (6-12 months)

- Graph the destination. Maintain an entity model for lakes, marinas, parks, safety considerations, and family‑fit attributes; keep it current with editorial and guest input.

- Conversational comparison. Generate “A vs. B” summaries that integrate distance-to‑amenities, review themes, and seasonality, so travelers spend less time tab‑hopping.

- Threaded post‑stay loop. Move from review request to “hold next season’s preferred week” in the same conversation.

Operating discipline throughout

- Use real‑time pricing that considers booking pace, local events, and orphan‑night fill to defend revenue as occupancy softens.

- Invest in speed: fast pages, instant answers, and response‑time SLAs for host and guest communications; compressed windows punish latency.

The Lake.com illustration: from prototype to playbook

Lake.com’s early conversational flows (LinkedIn Video) already do what many travelers expect from AI:

- “Show me properties in Austin under $200,”

- “Dallas or Houston houses for eight people,” “somewhere in San Antonio above $250 with a view,” and

- “available sometime in September within $180-$250.”

The point is not the novelty of chat—it is the compression of discovery, comparison, and planning into a single thread where the system knows the lake, the family, and the budget.

That thread becomes the backbone for everything that follows: a shortlist the family shares, a calendar suggestion that balances price and availability, a checkout that repeats the all‑in total in plain language, and on‑trip guidance that reinforces trust.

Bottom line

Travelers are getting conversational. Planning cycles are shorter; stays are slightly shorter; and platform shares are shifting. The interfaces that win will turn questions into confident choices—fast.

Are OTAs ready? Three questions separate leaders from laggards:

- Can your system understand intents like “quiet cove” and instantly map them to credible, local options?

- Can a traveler go from “compare A vs. B” to a held reservation—with a transparent price and policy—in one continuous conversation?

- After the stay, can the same thread help them relive the trip and reserve next season, closing the loop before another marketplace intercepts them?

Those who answer “yes” will not just keep up with changing habits; they will set the new standard for how travel is discovered and booked.